According to market intelligence company CONTEXT, in the first quarter of 2024, global 3D printer shipments started the year similar to what they ended 2023 with - China's industrial metal printer shipments increased, while industrial polymer printer shipments in all regions Volume was weak.

Across all regions, global shipments of industrial stereolithography printers were weak, which largely contributed to the 15% year-over-year decline in this price category. Mid-range shipments fell 7%, while sales of professional-price category printers continued to shift toward entry-level price categories. Professional-level shipments decreased significantly again during this period, down 34% from a year ago, while entry-level shipments increased, with global shipments up 26% from a year ago.

Among Chinese supplier groups, regional sentiment is divided. Suppliers involved in the industrial metal powder bed fusion space, in particular, are pleased with strong domestic demand, while Western suppliers say end markets continue to face challenges given reduced capital spending due to high interest rates and ongoing inflation. . However, in the United States and across Europe, the situation was not entirely negative, with many suppliers reporting strong demand from the domestic defense market during this period.

Industrial grade

According to CONTEXT’s latest market insights, global shipments of 3D printers across all industrial price categories fell by 15% in the first quarter of 2024, and have fallen by 8% cumulatively in the past 12 months. From a material perspective, polymers and metals accounted for a combined 96% of all industrial 3D printer shipments during the same period, with polymers accounting for 50% of total shipments in this category and metals accounting for 46%. Of the two major categories, weak industrial polymers shipments were a factor in overall category performance in the first quarter of 2024, with shipments during the period 29% lower than a year ago.

On the contrary, global industrial metal shipments increased by 10%. Looking at the past 12 months (TTM product launch cycle), global industrial polymer shipments fell by 16%, while industrial metal shipments increased by 4%.

Industrial polymer grade

The overall industrial 3D printer category has been dragged down by weak shipments of industrial stereolithography printers in the West (mainly the United States and Western Europe) and the East (mainly within China). Shipments of industrial polymer stereolithography printers fell 47%.

Overall, among the top ten global companies in this field, nine have seen shipments decline compared to a year ago, with most of them seeing double-digit percentage declines. Excluding stereolithography, shipments of systems in all other industrial price categories were down just 1% from a year ago. According to relevant reports, weak demand in the dental market in the two regions was the main reason for the year-on-year decline. Due to high inflation, the end market demand for more cosmetic dentistry has changed.

Industrial metal grade

In the first quarter of 2024, global shipments of various industrial metal 3D printers increased by 10% year-on-year, and shipments of metal powder bed fusion systems, which accounted for the largest share of 74%, increased by 7% compared with a year ago. .

During this period, shipments increased for all metal formats except material jetting, with directed energy deposition shipments up 21%, material extrusion up 32%, and binder jetting up 15%.

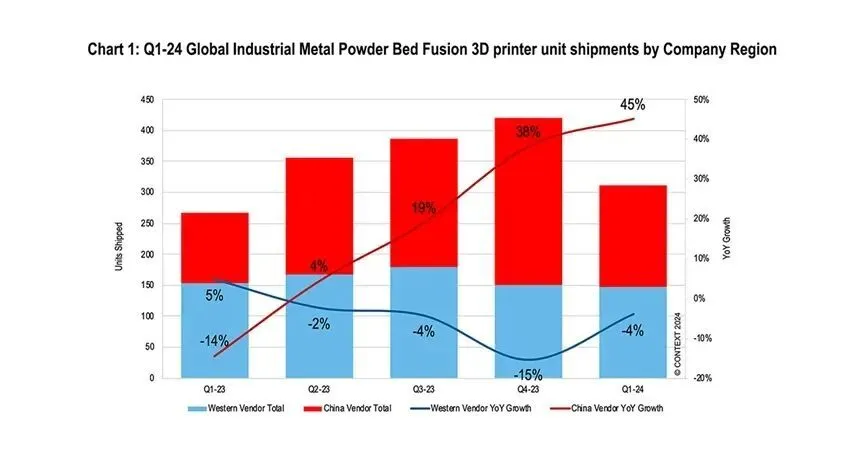

Demand for industrial metal powder bed fusion has been particularly strong in China, with shipments from Chinese suppliers growing by 45% during the period, compared with 1% of metal powder bed fusion (PBF) printer shipments from Western suppliers. It dropped by 4% a year ago. The quarterly shipments of Chinese suppliers have increased year-on-year for four consecutive quarters, while the shipments of Western suppliers have declined for four consecutive quarters.

During this period, four Chinese companies ranked among the top five global suppliers of industrial metal powder bed fusion printer shipments, including BLT, Farsoon High-Tech, Yijia 3D and Laser. Suppliers focused on Western markets continue to lead in system revenue contribution, with Nikon SLM Solutions and EOS enjoying the highest market share in metal powder bed fusion system revenue. Nikon SLM Solution is particularly eye-catching as a leader in large-scale, multi-laser systems.

mid-range

In the first quarter of 2024, mid-range 3D printer shipments decreased by 7%, mainly due to a 14% year-on-year decrease in polymer powder bed fusion printer shipments. Overall, demand is generally weak in both East and West in this price category, with shipments from Chinese suppliers down 1% year-on-year and Western suppliers down 9% in the first quarter of 2024.

Among the top five global suppliers in this price range, China's Zhongrui Technology is the only one with year-on-year growth in shipments. It not only performs well in terms of shipments of SLA stereolithography printers, but also its low-end metal powders. The same goes for the bed fusion product line. Other leaders in the top five, such as Stratasys, Luentech, Formlabs and 3D Systems, all saw slight year-over-year declines in product shipments in this price range.

Professional grade

During the first quarter of 2024, global shipments of professional-grade products declined again. Compared with the same period last year, global shipments of products dropped by 34%. This marks the category's eighth consecutive quarter of declining annual shipments, as inflation has largely shifted a portion of this buying group into the entry-level segment. Among the top 10 suppliers, except for two, the shipments of the remaining suppliers have declined year-on-year.

This period is in a transitional phase, as Formlabs and UltiMaker, the two leaders in price class, have both launched significant new products. While both companies have historically found success by expanding their offerings to higher price points and introducing distinctive products over time, UltiMaker has continued that tradition and even elevated its product portfolio to higher price points. level. For their material extrusion Factor 4, Formlabs has taken the opportunity to introduce a new generation of stereolithography at a price point similar to traditional premium price tiers.

beginner level

In the first quarter of 2024, 3D printer shipments in the entry-level price category accelerated, growing 26% from the first quarter of 2023. Nine of the top ten vendors in the space shipped more in the first quarter of 2024 than a year ago, with Tuozhu seeing the most significant growth. While Tuozhu once again leads the way in terms of growth, Chuangxiang 3D still dominates this price category, alone accounting for 56% of 3D printer shipments in the entry-level price category in the first quarter of 2024 alone. 2nd in this category. Accelerating adoption of entry-level price point printers in more professional end markets, including 3D printing farms, is helping this price category soar.

Except for Chuangxiang 3D and Tuozhu, shipments of the rest of the price category only increased slightly by 9% year-on-year. Many suppliers tried to capitalize on the success of Tuozhu's AMS automatic feeding system multi-color technology and introduced similar technologies to the market during this period. The U.S. market remains the primary end market for entry-level 3D printer shipments, with 42% of global shipments in the first quarter of 2024 going to this region. In the first quarter of 2024, approximately 94% of global entry-level 3D printer shipments came from Chinese suppliers.

future outlook

Discussions of industry consolidation have dominated conversations in the West recently, highlighted by Nano Dimension's planned acquisition of Desktop Metal. In the United States and Europe, ongoing merger and acquisition rumors continue to play out, and several listed companies are undergoing strategic reviews. In contrast, Chinese companies continue to thrive at home and focus on expanding overseas.

Western forecasts remain conservative, but strong Chinese demand, especially for metal powder bed fusion solutions, has led to a revision of global industrial printer shipment forecasts, which are now expected to grow by 7% in 2024. Demand from the Western defense sector for companies such as Nexa3D and Velo3D has also supported this growth. Midrange forecasts currently stand for a modest 3% year-over-year growth, while Professional is expected to decline 1%. Entry-level is expected to grow 14%, driven by new market options brought about by Tuozhu's success.

The industrial price category is expected to experience accelerated growth in 2025 and beyond as the U.S. and Europe stabilize after election cycles and interest rates decline. While system suppliers remain committed to further advancing additive manufacturing into mainstream manufacturing, many strategic growth initiatives are now beginning to incorporate other digital production technologies in addition to additive manufacturing into their product portfolios as a way to accelerate growth.

Hot News

Hot News2024-07-26

2024-07-26

2024-07-26